Remote Property Appraisal Management System

About Client

Industry

Real Estate

Location

USA

Project Overview

Our client encountered challenges with the traditional property appraisal process, which involved time-consuming steps such as scheduling property visits, on-site manual data collection, manual handovers to technicians for floor plan creation, and, finally, the submission of appraisal reports.

This approach was not only resource-intensive in terms of time and cost but also susceptible to human errors and delays due to manual processes.

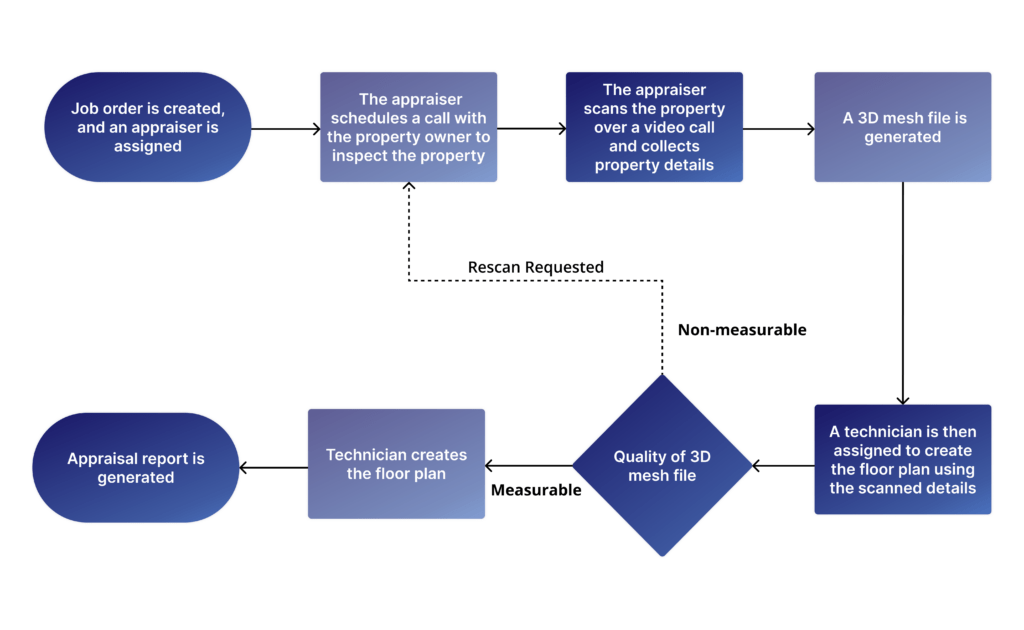

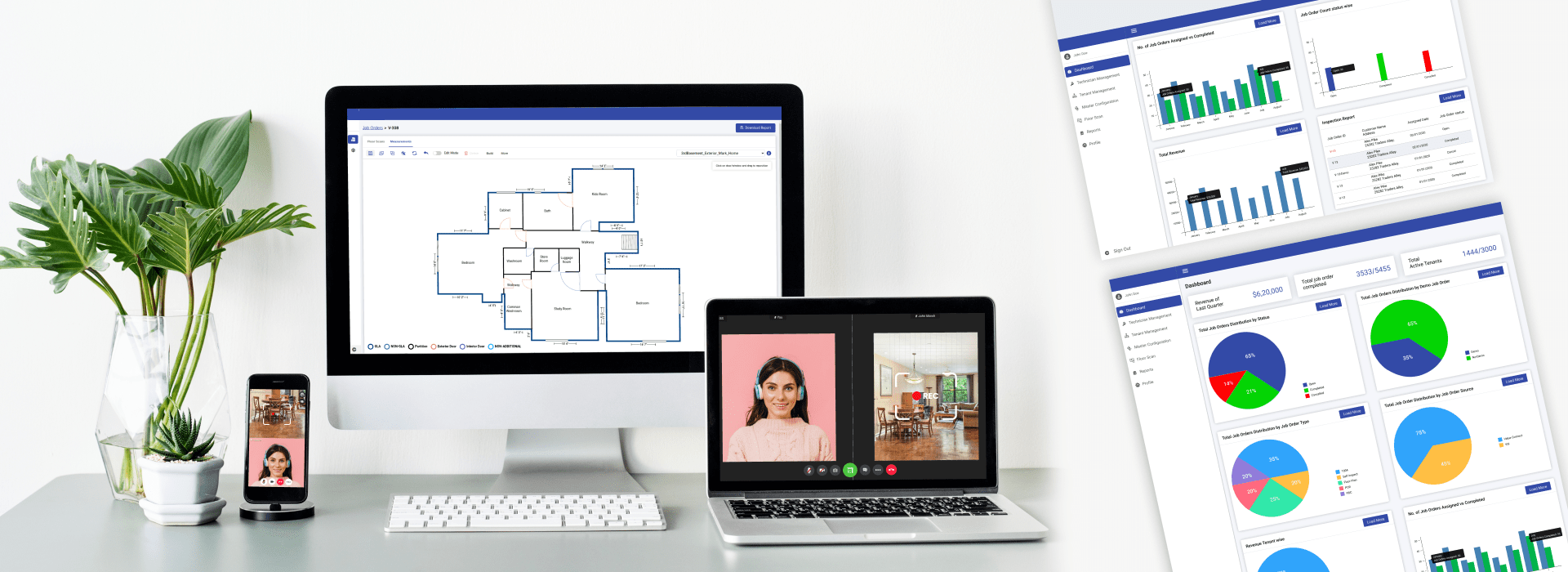

In response to the challenges, we introduced a remote property appraisal solution. It assigns an appraiser to the property owner, who conducts a thorough assessment via video call, and then the system automatically generates a 3D mesh file from the data collected for creating precise floor plans using our builtin floor plan creation tool. For users with LIDAR devices, automatic floor plan creation is available. This optimized process reduces travel time, costs, and human error while enhancing efficiency. The outcome includes a detailed appraisal report, higher monthly appraisal counts, and increased client satisfaction.

Traditional Property Appraisal Process

01

02

03

04

05

06

Challenges In Traditional Property Appraisal Process

01

02

03

Manual Data Collection Leading to Potential Errors: Another challenge arises from manual data collection, which can result in errors in measurements and property condition assessments. Moreover, it may introduce delays in the appraisal process.

04

05

Our Solution

01

02

03

04

05

06

07

Outcome

36% Increase in Profit

90% Reduction in delays

Human error reduced from 7.5% to 1%

100% Boost in Happiness of All the Parties

80% Efficiency increase

75% Improved client feedback

80% Improved quality of appraisals (benefiting lenders/mortgage industry and offering better deals)

Significant environmental benefits, including reduced carbon emissions and sustainability promotion

Infinite blessings Received from the Property Owners and Mortgage Companies

Appraisals completed a year:

Traditional System - 62,500 (Fees 500 USD - Cost 300 USD)

Remote System - 1,00,000 (Fees 350 USD - Cost 100 USD)

Total appraisers 100

Profit Difference: (Remote) $4,74,50,000/Y - (Traditional)$3,46,75,000/Y = $1,27,75,000/Y

90% reduction in delays

Human error reduced from 7.5% to 1%

Significant environmental benefits, including reduced carbon emissions and sustainability promotion

80% efficiency increase

75% improved client feedback

80% improved quality of appraisals (benefiting lenders/mortgage industry and offering better deals)

100% Boost in Happiness of All the Parties

Infinite blessings Received from the Property Owners and Mortgage Companies

Features Of Remote Property Appraisal Management System

Job order management

Effective call scheduling

Remote Inspection via Video Call (including scanning, recording, screen sharing, and real-time chat)

Built-in Floor Plan Creation Tool

Automatic 3D Floor Plan Creation For LIDAR users

MLS (Multiple Listing Service) Data Feeds

Google Maps Integration

RELAR Analytics for detailed property insights

Walk Score API

3D Virtual Tours

Mortgage Calculator API

Technologies Used

Front-end

- ReactJS

- AngularJS

Backend

- MVC .NET and .NET Core

- Ruby

Android

- Kotlin

- MVVM architecture

- Google Maps API

IOS

- Swift

- Viper architecture

- Google Maps API

Database

- PostgreSQL

Server

- Azure Cloud

Third party Integration

- Azure blob Storage

- AWS S3

- Sentry

- SendGrid

- Twilio

Flow Diagram Of The Remote Appraisal Management System